Any time you are spread betting on the Forex markets, and in particular on the euro versus the US dollar, you need to undertake research as if you were going to become a Forex trader. The Forex market tends to be more expensive to trade directly than spread betting, which allows you to bet perhaps as little as £1 per point or pip, depending on your spread betting provider. Nonetheless, the analysis that a Forex trader makes is just as valuable to you.

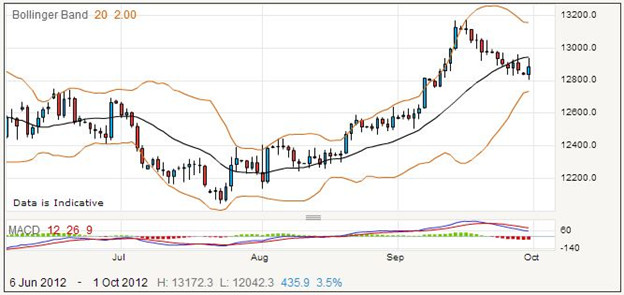

This daily price chart shows the number of US dollars that you can buy for one euro, as the euro is the first and base currency. Because it is denominated in points, a value of 12,800 means that one euro equals US$1.28.

When assessing the strength of a country’s currency, you need to bear in mind such figures as the balance of trade, the unemployment, the gross domestic product, and several other national statistics. Remember that you are comparing one country’s economy with another (or in the case of the euro with several others), so you are judging which is stronger or weaker. It is often considered good advice to stay out of the trading markets altogether if a financial announcement is expected, as the markets can react quickly and not always in the direction that you may expect. However, this is a matter of personal preference, as some people thrive on such stress!

Having fully understood the fundamentals of the economies, you still have technical analysis to help you determine the sympathy of the market, which after all is what moves any prices. In the chart above you can see that the MACD confirmed the uptrend in September, and has shown the current downtrend. As it appears that the Bollinger Bands are narrowing, in this case you would watch the progression of the price in anticipation of a possible breakout. When the current downtrending price meets the lower Bollinger Band, then you would be able to watch and react to the outcome.

Forex EUR/USD Rolling Daily

Spread betting on the EUR/USD is an inexpensive way to become involved with the relative values of two major currencies. Given the economic unrest in recent years, there have been many opportunities to profit from currency trading. The current spread betting quote for the EUR/USD on a rolling daily basis is 12929.4 – 12930.2 with IG Index. If you think that European troubles are continuing, and have a pessimistic view of the euro, then you may wish to place a sell or short bet on this currency pair, staking perhaps £2.50 per point or pip.

What if in a few days the price slipped several hundred points? You might choose to close your bet and collect your winnings. Say that you did this when the current quote was 12,658.3 – 12,659.1. To work out what you won, you first calculate the difference in points. Your short bet was placed at the selling price of 12,929.4. You closed it when it reached 12,659.1. This means your sell bet made 270.3 points, the difference between these. Multiplying by your stake, you would have won £675.75.

Now consider the other case, when your bet is a loser. Perhaps the price would go up to 13,136.9 – 13,137.7 before you decided to close the bet and accept your loss. The starting price was the same as before, 12,929.4, but this time the bet closed at 13,137.7, for a difference of 208.3 points. At £2.50 per point, you would have lost £520.75.

You will find that many spread betters use stop loss orders to take care of closing any bets that turn out to be losers. If you had used one, possibly your spread betting provider would have closed the bet for you after the price had risen to 13,026.5 – 13,027.3. In this case, your starting price of 12,929.4 is taken away from a closing price of 13,027.3, giving you a loss of 97.9 points. The cost of this would be £244.75.

EUR/USD Forex Spread Betting: Futures

Suppose you believe that over the next few weeks or months, the euro is going to strengthen in comparison to the US dollar. You could consider placing a futures based spread bet on the EUR/USD, taking a long position for £1 per point. The current quote for the far quarter is 12,953.2 – 12,964.0. Your bet will be placed at the buying price of 12,964.0.

If you are correct and the price rises, you may be able to close your bet and collect your winnings when the quote is 13,327.6 – 13,336.2. Your long bet would close on the lower price of 13,327.6. Taking the difference in points, 13,327.6-12,964 is 363.6 points. As you staked £1 per point, this means you have won £363.60.

Even though you have placed a futures based bet with an expiry date many months in the future, you can close the bet any time that you wish. So if the price went down as soon as you had placed your bet, you might decide to end the trade and prevent any further loss when the quote was 12,686.5 – 12,695.6. Your closing price would be 12,686.5, which taken away from your opening price means you lost 277.5 points. Because you staked £1 per point, on this bet you have lost £277.50.

Many traders are concerned that their bets may go into losing territory while they are not online or watching the market, so they use a stop loss order to take care of ending a losing trade automatically. This bet may have cost you less if you had a stoploss order, as it might have activated and closed the bet when the quote was 12,752.6 – 12,761.0. Working out your losses this time, 12,964.0 less 12,752.6 is 211.4 points. Your losses would have been kept down to £211.40.

Leave a Comment