Pepperstone Group Limited was established in 2010 in Australia. It is licensed by ASIC (ASIC license number is AFSL 414530) and it offers forex and CFD trading services to clients in Australia as well as a number of other countries. As a regulated operator, Pepperstone Group keeps its clients’ monies in segregated accounts with the National Australia Bank. The operation is also subjected to regular third-party audits, by Ernst and Young.

The UK subsidiary of the operation was established in 2016. Pepperstone Ltd is based in the UK and is licensed by the country’s Financial Conduct Authority (FCA license number of the operation is FRN 684 312). The address of the operation is 70 Gracechurch St, London, UNITED KINGDOM EC3V 0HR. Like its parent company, Pepperstone Ltd. keeps its clients’ monies in segregated bank accounts too, with Barclays.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pepperstone offers clients the ability to trade a good range of markets including over 61+ forex currency pairs, 14 major global stock indexes, 61 individual US equities, 6 precious metal pairs, oil and gas commodities, and 4 cryptocurrency CFDs.

- 61+ currency pairs.

- Trade on the movement of 14 major stock markets around the world, including US, Europe, Australia, and Asian indices. These are offered with fixed spreads during market opening hours.

- Trade commodities such as coffee, cocoa, cotton, orange juice, and sugar.

- You can also trade products such as gold, silver, platinum, and palladium at tight spreads with no commission.

- Gain exposure to 60+ top-quality stocks, such as Apple, Alphabet, Tesla and Alibaba, and take advantage of reporting season with Pepperstone’s after-market trading hours and commissions from USD$0.02 per share.

Pepperstone claim that they operate under a ‘No Dealing Desk’ broker model and have a policy of not trading against their own clients. Their prices are sourced from a list of liquidity providers and only the best prices are shown. This means spreads are kept tight while also ensuring that your goals are aligned with the spread betting and CFD provider, putting to bed the prospect of being stop hunted.

Trading Accounts

Pepperstone offers trading on both the MT4 and MT5 platforms. The spreads are variable, with quotes sourced from around 22 major banks and electronic crossing networks.

Two types of accounts are offered; namely Standard and Razor.

The Razor account offers very tight spreads with no markups, meaning that the average EUR/USD spread is between 0 – 0.3 pips. Instead, they charge a commission of $5.58 (GBP4.59) per 100k units round turn for EU clients and $4.74 (AU$7) for overseas clients. This account would be suitable for traders who like to trade very frequently or algorithmic trading.

The Standard account comes with slightly higher spreads due to the markup. The typical EUR/USD spread here is between 1 – 1.3 pips. The good thing about standard accounts is that they’re no additional commission so it could be a good choice for beginners.

All Pepperstone accounts permit scalping, trading robots, and hedging. EU accounts require a minimum deposit of £200 and offer a leverage of up to 30:1. International accounts have a minimum deposit requirement of AUD 200 and a leverage of up to 500:1.

Note that Pepperstone offer demo accounts which last for 30 days from the date of application, although you may be able to extend this period on request.

Spread Betting

Pepperstone is one of the few providers out there that allow you to trade via spread betting on the industry leading platforms MT4, MT5 and cTrader. Most others providers will only allow you to trade forex or CFDs which is not great for UK residents.

Spread betting profits are tax free for residents of the UK and Ireland. You don’t pay stamp duty either as you never own the underlying asset. In the UK spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

Pepperstone’s Spread Betting Offering includes:

- 150+ instruments to trade

- Access to industry-leading platforms MT4 and MT5

- Low latency, lightning-fast execution

- Consistently competitive spreads

- Automated trading when you build your own trading strategies

To open a spread betting account with Pepperstone, you must be a resident of the UK or Ireland.

Pepperstone permits leverage for clients that qualify for a professional account of up to 500:1 whilst the more inexperienced trader will have access to leverage of 30:1. For cryptocurrencies, Professional Clients can trade at 5:1 while Retail clients can access up to 2:1 leverage.

Pepperstone Educational Resources: Pepperstone has an educational section under the Client Resources tab of its website.

Articles: The broker provides articles on forex trading, including features covering terminology, fundamental and technical analysis and order types.

Webinars: Traders can also sign up for online seminars and recordings of previous webinars, which are all available on the site

Trading Guides: Pepperstone publishes a good selection of trading guides that cover topics of interest to its clients

Support: This section offers troubleshooting advice on the broker’s platforms and other topics.

FAQs: A section covering the most frequently asked questions regarding trading with Pepperstone.

There is also a Trading Essentials section under the Client Resources tab. This section has a Market Review with articles on topics moving forex markets, an Economic Calendar and a section on the Pepperstone technical analysis software.

Pepperstone also offers several third-party social copy-trading platforms and research tools including Myfxbook, ZuluTrade and Mirror Trader. Pepperstone also offers AutoChartist to live account holders, which is a tool that helps with automated pattern recognition and trading signals.

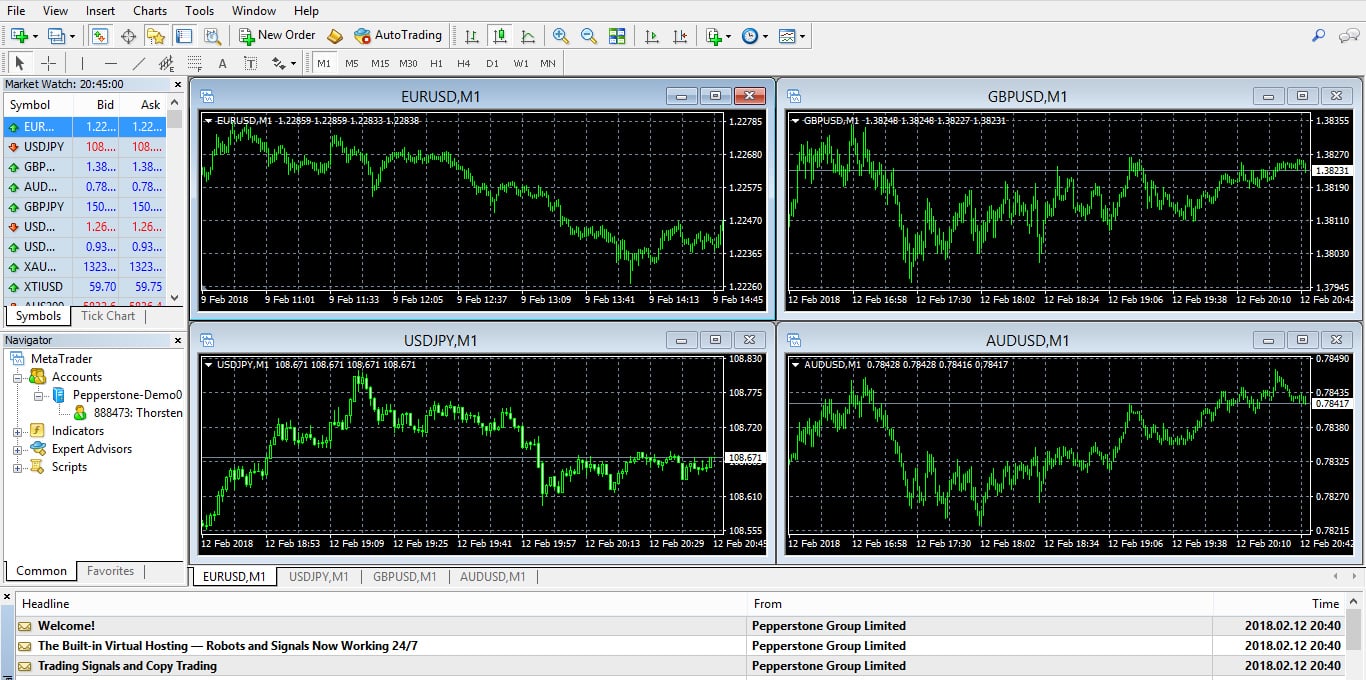

MetaTrader 4 Trading Platform

Traders at Pepperstone are given access to the award-winning, MetaTrader 4 forex platform, considered by most traders as the leading standard for currency trading. The MetaTrader 4 software needs to be downloaded to desktop directly from the Pepperstone interface or you can make use of the online (lite) platform. The MT4 is quite reliable, secure and user friendly including support in a number of languages. It also includes a large selection of tools to help with trading analysis, including technical indicators and charts for detailed analysis. For traders interested in automated trading, the Pepperstone MT4 platform can also be utilised with trading robots (Expert Advisors) imported to the platform from third parties.

MetaTrader 5 (MT5) Platform

Pepperstone also offers the MetaTrader 5 (MT5) platform which is similar to MT4 with some extra features including 21 time frames, 6 types of pending orders, more technical analysis indicators and an integrated economic calendar. MT5 also has around 300+ trading instruments compared to the 100 on MT4.

Despite the fact that the MetaTrader 5 trading platform has more capabilities than MT4 and is the more modern platform, the older counterpart still remains the most popular amongst traders. This could be due to the fact that MetaTrader 4 has thousands of additional custom indicators and EAs available online. You can visit Pepperstone Broker here

cTrader Platform

Pepperstone also offers the emerging cTrader developed by Spotware. The platform itself is fairly intuitive and easy to use incorporating an ability to customize multiple settings and views within the platform. Alerts are also easy to set up within the cTrader platform so you know when a market hits a certain level.

This platform offers good charting and trading features and includes support for Android and iOS devices. The available functions include the ability to place most type of orders including market, limit, stop-loss, stop limit, trailing stop orders. cTrader also offers level 2 pricing and enhanced charting capabilities which are detachable from the main platform window.

Comparing the cTrader platform to MT4, cTrader has:

- Advanced order protection (which MT4 lacks)

- Better charting options (ability to detach charts and move them to say, a different monitor)

- Better timeframe options (lots of different timeframes available)

- Depth of market functionality which is useful

- Ability to manage trades

Pepperstone is regulated by ASIC and the FCA, so you can be assured that you are dealing with a legitimate broker.

The Pros:

Advantages and Disadvantages

- World class customer service

- Competitive spreads and pricing

- ASIC and FCA regulated (UK)

The Cons:

- Non-straightforward funding cost/interest rates

- Limited research

- Only third party trading platforms

With the ability to trade on the world’s most popular Forex trading platforms MetaTrader 4, MetaTrader 5 and cTrader – across Windows, Mac, Web, Android and iOS – Pepperstone caters to all types of traders. Many traders will also enjoy the additional features of AutoChartist and the Smart Trader Tools packages. Visit Pepperstone here.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.